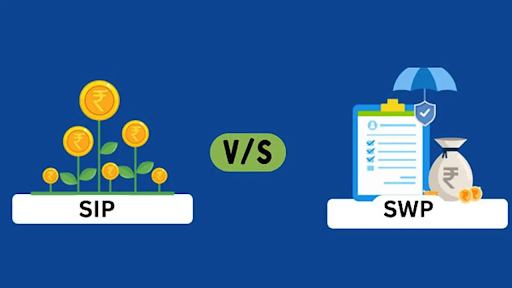

Investing for your future is fundamentally about creating financial security; figuring out where and how to invest can be confusing and daunting. The two most popular investment strategies in India are SIP and SWP. Although both have important roles to play in a person’s financial plan, they function differently for different purposes. Let’s discuss the largest differences between the two investment plans and how each can benefit you.

What is a Systematic Investment Plan (SIP)?

A Systematic Investment Plan (SIP) enables investors to invest a fixed amount of money at periodic intervals in Mutual Funds. It facilitates disciplined investment by forcing the investor to invest a fixed amount on a regular basis rather than an occasional lump sum investment. It minimises the effects of market volatility and lowers the risks of investing at the wrong time. With a SIP, one begins with as little as a few hundred rupees and increases investments over time. In the long run, the compounding power generates huge returns, making it a perfect option for those who want to create wealth in the long run.

Advantages of SIP

- Simple and Regular Investing: With a regular monthly payment, the Systematic Investment Plan simplifies saving and investing.

- Rupee Cost Averaging: As you invest a fixed sum each month, you purchase more units when the price is low and less when the price is higher. This approach reduces the overall cost of investment.

- Compounding Power: SIPs are compounded over time by reinvesting gains, resulting in compounded growth. The longer you stay invested, the greater the returns.

What is a Systematic Withdrawal Plan (SWP)?

A systematic withdrawal plan (SWP) is the reverse of SIP. Under an SWP, investors withdraw predetermined amounts of money from their Mutual Fund periodically, say monthly or quarterly. It is a handy device for those who wish to draw a regular income from their investments, such as retirees or others requiring additional cash flows. When you invest in Mutual Funds and need to have regular access to your money, an SWP is the order of the day. While in SIP you’re investing, in SWP you’re withdrawing your investment, based on your requirements.

Benefits of SWP

- Regular Cash Flow: An SWP provides you with a steady flow of money, which proves useful during retirement when you require a regular income.

- Flexible Withdrawals: The frequency and amount of withdrawal may be changed according to the individual’s needs, providing flexibility.

- Tax Efficiency: Depending on the length of time that funds are held, the amount of funds withdrawn can qualify for beneficial tax treatment and, as such, result in tax savings.

Understanding the key differences between the two is essential to making a decision about which SIP or SWP best suits your investment purposes.

Purpose of Investment

- SIP is for wealth creation. Contributing regularly assists you in creating a corpus in the long run.

- SWP is used for the decumulation of wealth. It’s used for generating periodic income, especially in retirement or when more cash flow is needed.

Cash Flow Direction

- In SIP, money flows from the investor to the Mutual Fund.

- In SWP, money flows in the opposite direction—back to the investor from the Mutual Fund.

Ideal for

- SIP is best suited for young working professionals, long-term investors, and individuals who wish to build wealth over the long term.

- SWP is best suited for pensioners or individuals who have to make regular withdrawals to cover their lifestyle expenses.

Applying SIP and SWP Together for a Balanced Approach

Rather than picking to invest mechanically either through SIP or through SWP, investors typically opt to combine both SIP and SWP. Start a Systematic Investment Plan when you are young to accumulate wealth then convert to a SWP when retired to alternate between growth and income. For instance, an individual could initiate a SIP in their 30s to create a retirement corpus. Once they retire, they may initiate an SWP to receive a fixed amount each month, and this would give them a regular flow of income throughout their retirement years. Applying both methods will assist people in managing their wealth in such a manner that it caters to their short-term requirements and long-term objectives.

How to Plan Withdrawals Using the SWP Calculator?

Before you create an SWP, it is advisable to know how much you will have to withdraw periodically. This is where a Systematic Withdrawal Plan Calculator comes in handy. Online calculators allow you to compute the amount that you can withdraw without affecting your investment’s long-term growth. All you have to do is enter details such as the amount to invest, the expected returns, and the withdrawal frequency, and the calculator provides you with an accurate notion of how much you can withdraw and for how long your corpus will last. It is a simple yet effective way of budgeting your money and not depleting the funds in the short term.

Points to Consider Before Choosing SIP or SWP

While deciding between a Systematic Investment Plan (SIP) and a Systematic Withdrawal Plan (SWP), one must consider several important points in accordance with your financial goals and personal circumstances.

Risk Tolerance

- SIPs are more suitable for people with a greater risk tolerance because investments in mutual funds are influenced by the market’s ups and downs. However, due to the long-term nature of SIPs, the risk is lowered in the long run.

- SWP is commonly adopted when the individual has achieved an age when they are searching for stability and a consistent flow of money. The corpus risk should be weighed.

Financial Goals

- If you want to save for a future milestone, such as buying a house or funding your child’s education, an SIP is the ideal choice.

- If your goal is to create a steady income stream for retirement, SWP works best.

Taxation

Both SIP and SWP are taxable. The return on SIP is taxed based on the duration for which the units are held before redemption. Short-term capital gains (STCG) have a tax of 15% attached, whereas long-term capital gains (LTCG) have a tax of 10% for some amount. For SWP, the treatment of tax also varies based on the time for which the money is invested. Withdrawals at regular intervals can draw short-term capital gains tax.

Conclusion

SIP and SWP are two options that suit different needs when it comes to investing and withdrawing money. SIP helps you grow your wealth in the future, while SWP provides you with a regular inflow of funds during your moment of need. Mixing both strategies according to your life stage and financial requirements is an intelligent step to frame a balanced financial plan. In making effective withdrawal decisions, applying a Systematic Withdrawal Plan Calculator will guide you in managing your finances well. With awareness of the advantages and working of SIP and SWP, one can maximise one’s investments for growth and regular income.